Every one of us, at least once, has indulged in purchasing goods and services online and paid for them electronically or through an e-payment mode, where the transaction takes place electronically and not through cheques or cash. Sprouting under several names, e-payment or online payment system comes with multiple payment methods like Credit and Debit Cards, Net banking or IMPS.

The evolution and growth of the electronic payment system has sprung in the last decade and can be attributed to the developing internet speed and technology which has indefinitely pushed the consumers towards online shopping and internet-based banking services thereby, reducing the overall usage of cash.

With the constant rise in the number of consumers preferring to pay via online transfers and retailers selling over the internet, eliminating cash payments, will sure propel us into the future of globalization, where cash would be a thing of the past.

How does e-payment system work?

Electronic payments are instant and therefore convenient, saving a lot of time. How simply, with a click of a button, you successfully pay for your favorite dress, or order groceries or make an online booking. Even though all of this happens in a span of seconds, the process behind this is quite comprehensive.

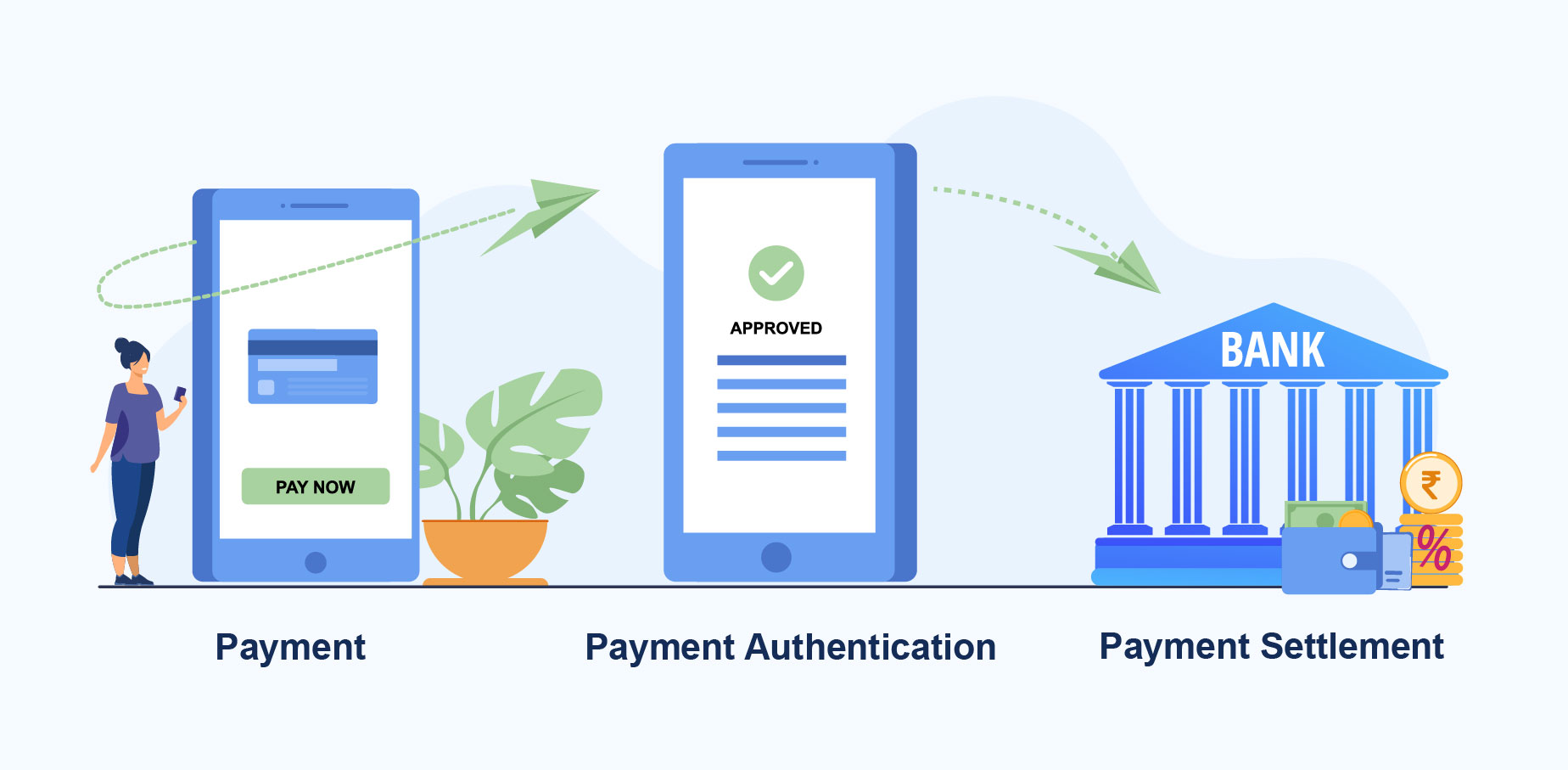

Customer Action: The journey of an electronic payment begins with a customer visit a merchant’s site, add products or services they want to the cart and clicks on the checkout button. Post this, the customer chooses his preferred form of payment option and proceeds towards filling in the banking or card details. The customer then, is redirected to the bank’s page to proceed with the payment.

Payment Authentication and Authorization by the Operator: Once the customer proceeds with the payment, the payment gateway along with various parties involved, authenticates if the payment information entered is valid. Upon entering valid information, a successful transaction message is reported back by the payment gateway, informing the customer about the payment confirmation on real-time basis.

Payment Settlement in Merchant’s Account: On fulfilling the transaction, the Online payment provider receives payment from the customer’s bank account and transfers the same into the Merchant’s account.

Methods of e-Payments

Card Payment System: Card payment system involves initiating payments online or through an electronic device and requires the use of a credit or debit card issued by a financial institute to the cardholder for making payments.

Net Banking or Internet Banking: Net banking system involves the transfer of funds digitally to one another via the internet without having to physically visit the bank or any of its branches. Few modes of net banking include IMPS, RTGS, NEFT.

E-wallet: A prepaid form of account, e-wallet is where the user’s financial data like debit or credit card information is stored in order to process electronic payments.

Smart card: Smart card is a plastic card with a microprocessor chip inserted that can be loaded with funds to make transactions safe and hassle-free.

Direct Debit: Direct Debit is an arrangement made with a bank that allows a third party to transfer money from a person’s account on an agreed date for an agreed sum, electronically, to pay for goods or services.

Stored-value card: This card involves a certain sum amount of money to be stored in the card beforehand and can be used to perform a transaction at the issuer store. A typical example of stored-value cards is gift cards.

UPI or Unified Payments Interface: UPI is an instant, real-time payment system developed by the National Payments Corporation of India facilitating inter-bank transactions of funds on a VPA and is secured with an MPIN.

QR (Scan and Pay): QR or Quick Response Code is a machine-readable code that consists of a matrix of dots in a black and white square, which can be scanned by any mobile banking application to process and disburse payments.

Why use an Electronic Payment System?

E-payment system has stunned the financial market in a way people could have never thought of. With the growing popularity of online shopping, electronic payments have become a need of the hour for the customers who buy online, making shopping and banking services more convenient than ever.

Here are some of the key benefits for merchants adopting e-payment:

- When retailers or online shoppers promotes/supports e-payments system on their website, they can reach out to more prospects from all over the globe, therefore resulting in increased sales and revenue growth.

- The e-payments system is a channelized and systematic structure of money collection where transactions and payment transfers happen within minutes, topped with high speed and accuracy.

- Convenience is yet another feather to its hat. Customers today can indulge in shopping and banking services at any time of the day or hour, simply with an internet connection.

- Lower transaction cost and decreased technology costs only adds more profits to the business and encourages regular discounts on products which leads to bulk purchase by consumers.

- E-Payment gateways providers offer high security and anti-fraud to make transactions more reliable, safe and secure for both- the merchants and the consumers!

E-payments are considered as one of the fastest and most secured alternative to traditional payment methods like cash & cheques. Accepting electronic payments comes with lots of benefits for both merchants and consumers as it is highly effective for international transaction and is comparatively cheaper.

With e-commerce and m-commerce getting bigger year after year, make sure your website does not miss out on customers simply because it is not integrated with an electronic payment system. Atom’s payment gateway lets you accept electronic or online payments through multiple modes, helping you to translate more sales.

5 Comments